كوكبة من كوادر ريادة الأعمال

فريقنا قادر على حل كافة المشكلات ومعالجة أي عقبة قد تعوق عملك، سعيا لخلق بيئة عمل صحية ومنتجة، تثمر بذاتها في تحقيق معدلات النمو القصوى والحفاظ على استمراريتها

تعتمد شركة المحاسبون القانونيون المصريون في أعمالها على كوكبة تحوي أكثر من خمسة وعشرين من أهم وأشهر المحاسبين والمراجعين والمهندسين، فضلًا عن الكوادر الإدارية والقانونية المتميزة

يتمتع فريق شركة المحاسبون القانونيون المصريون بالكفاءة والمهنية والخبرات اللامحدودة، ما أهلهم لتقديم أحدث وأنسب الحلول التقنية ومعالجة كافة الأنظمة في القطاعات المختلفة

ساعدت الخبرات الممتدة التي يتمتع بها فريقنا المميز علي تحقيق أعلي معدلات النمو المستهدفة لكافة العملاء، وتوفير بيئة عمل صحية منتجة تحافظ على استمرار النجاح ونموه

ولذا يفخر المحاسبون القانونيون المصريون بامتلاك هذا القدر الفريد من الخبرة والمستوى المهني العالي للفريق، وهو ما أثمر تاريخا حافلا بالانجازات، كان ولا يزال بامكانه النهوض بشركات عملائه على النحو الأمثل

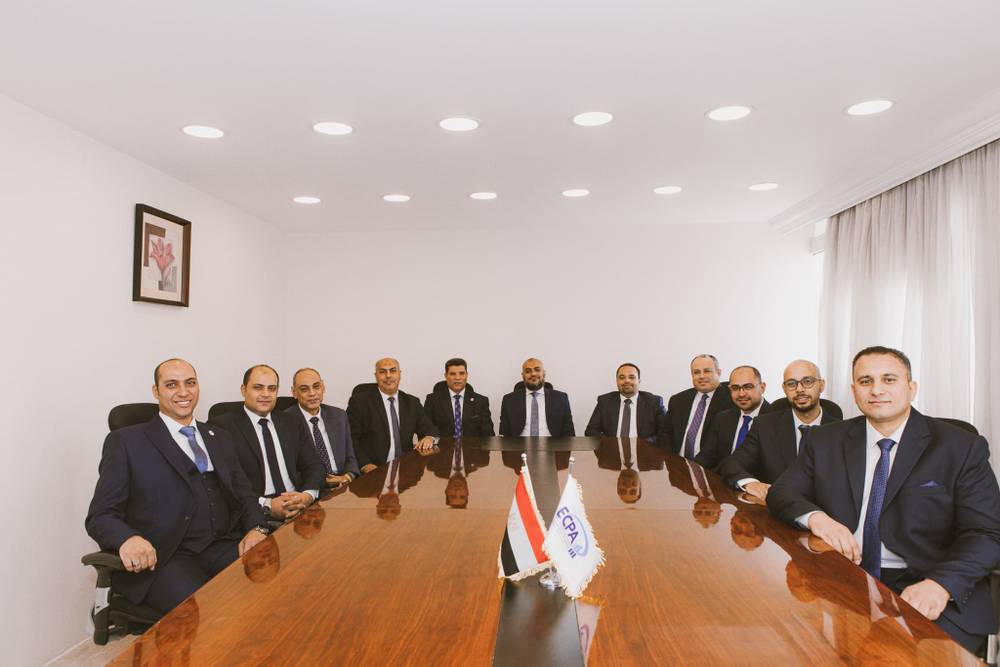

مجلس إدارة المجموعة

أشرف حجر

رئيس مجلس الإدارة

عطيه حمدى

شريك تطوير وتشغيل نظم المعلومات الآلية

تامر محمد نصير

شريك إدارة الضرائب والتخطيط الضريبي

مصطفى حسنى

شريك الضرائب الدولية

عامر إبراهيم

عضو مجلس الإدارة للتدقيق والمراجعة

عمرو فرج

شريك تنفيذي تخطيط وتطوير أنظمة الرقابة الداخلية

علاء الدبيكى

عضو مجلس إدارة للشئون القانونية

أيمن حجر

شريك إدارة إمساك الحسابات